fund accounting

Fund accounting software for more efficient processes and accurate data

Foundations

An integrated fund accounting system eliminates wasted time on unnecessary data entry, frustrations running ad hoc reports, and policing data coming from too many sources.

Stop duplicating data and focus on strategic impact for your community

Oversee all activities related to fund accounting activities with Foundant’s solutions designed to help your organization streamline your financial management.

- For foundations and philanthropic organizations with complex fund accounting needs – streamline operations, automate investment allocation, enhance donor access, and support flexible fee structures while ensuring accurate data entry.

Streamline your fund accounting

Assess and allocate administration fees

Assess and accurately allocate administration fees to support your unique fee structures.

Empower your donors with information

Provide donor access through the Donor Portal, allowing fund advisors to see their giving history, recommend grants, and view real-time account activities.

Spending policy management

Manage spending policy distributions and create multiple distribution types to align with your foundation’s spending policy.

Grant and scholarship accounting

Efficiently manage grant and scholarship accounting with seamless flow of financial information between systems.

Financial reporting by fund types

Easily view financial reporting by multiple fund types.

Easy fund statements

Easily create fund statements with up-to-date information in real-time for donors, leadership, or board visibility.

Investment activity allocation

Allocate investment activity across your funds upon receipt of investment statements.

Balances and transfers

Transfer balances between accounts and funds to manage cash within the system.

Foundation-specific reporting

Prepare 990 and other foundation-specific reporting easily and quickly.

Foundant Fans

Become a happy client!

Foundant has strong, relevant products for community foundations. It is focused on keeping its products up to date and has excellent customer service.”

Meghan Warrick

Central Florida Foundation

Great product! Combining ability to manage fund accounting with CRM is a win.”

Kent Embree

CF Serving West Central Illinois & NE Missouri

Meanwhile, we got our fund statements out earlier than EVER before. That’s the software at work. It’s not perfect, but it’s pretty dang fantastic!

Amy Owen

Community Foundation Loudoun and Northern Fauquier Counties

Ready to explore our fund accounting software?

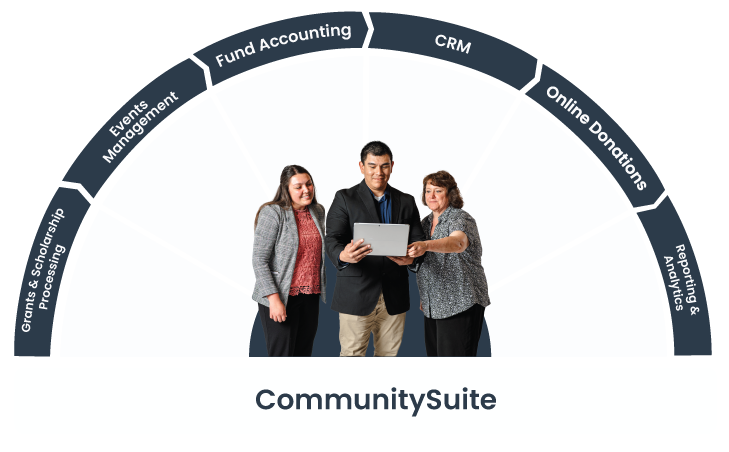

Join the over 640 clients using Foundant’s core enterprise solution supported by our commitment to collaborative development and exceptional client experience.

Fund accounting software FAQs

What is fund accounting?

Fund accounting is a financial management approach used primarily by nonprofit organizations, government entities, foundations, and other entities that do not operate for profit. It focuses on accountability over profitability, emphasizing the use of funds according to specific purposes or restrictions. Learn more about fund accounting best practices

What is fund accounting software?

Fund accounting software is a specialized tool designed for nonprofit organizations, government agencies, foundations, and other entities that need to manage finances based on specific funding sources. Since funding for these organizations often comes with restrictions, it is essential to track and report on each fund separately. Fund accounting software assists in managing these complex requirements effectively.

Why do not-for-profit organizations use a fund accounting system?

Not-for-profit organizations rely on fund accounting systems to address their specific financial management needs and accountability.

Key reasons include:

- Accountability to Donors and Grantors

- Compliance with Legal and Regulatory Requirements

- Clear Financial Reporting by Fund Type

- Effective Budgeting and Financial Planning

- Supporting Mission-Focused Operations

- Enhanced Transparency

What is the difference between fund accounting and normal accounting?

Fund accounting differs from “normal” (or traditional) accounting primarily in its purpose and structure. Traditional accounting, typically used by for-profit businesses, focuses on profitability, while fund accounting, used by nonprofits and government entities, emphasizes accountability and the appropriate use of funds.

What is fund balance in accounting?

In fund accounting, the fund balance represents the net assets or “equity” of a specific fund, calculated as the difference between a fund’s assets and liabilities. This balance indicates the financial resources available within that fund, which can be used or reserved for particular purposes. In nonprofits and government entities, fund balance provides insight into the organization’s financial health and the availability of funds for future activities.

What are other terms for Fund Accounting?

- Investment accounting

- Portfolio accounting